Taiwan’s Green Giant

Trusted by All Citizens

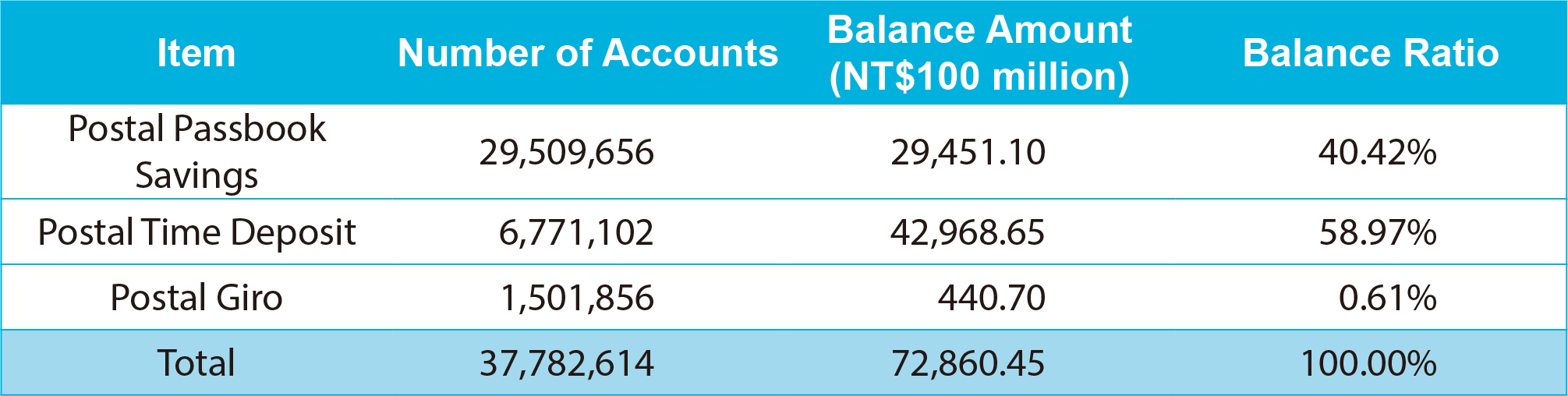

As a good neighbor to all people, Chunghwa Post is currently the largest depository institution, and the balance of postal savings deposited amounts to over NT$ 7 trillion, making Chunghwa Post the largest depository institution in Taiwan, also nicknamed the “green giant” by the financial industry. In the future, it will continue to promote various businesses such as the salary deposits, online post office (iPost), Mobile Post Office app, WebATM, Visa debit card, mobile payment, and digital account to increase the share of depository funds.

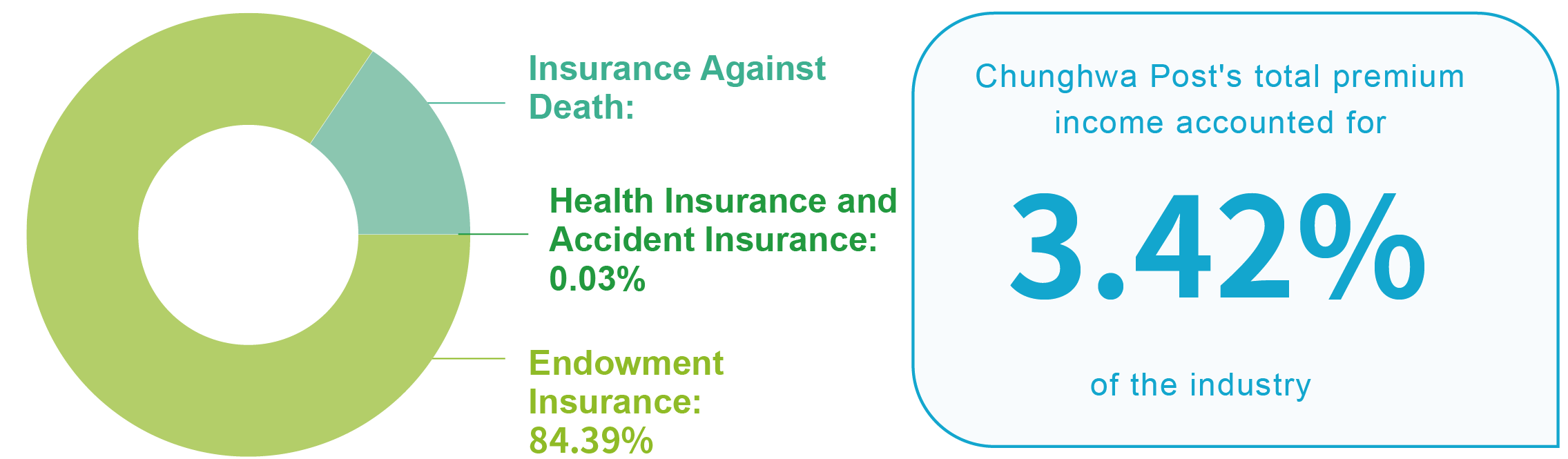

Postal Simple Life Insurance features non-physical examination insurance with simple procedures, providing all R.O.C. citizens with basic financial security. In addition, one-stop insurance coverage and claim services are available at the post offices across Taiwan, which is well-received by the general public. The number of policies (in force) as of the end of 2024 was 2,195,285 with the insured amount of NT$717.77353 billion and the total premium income amounted to NT$75.84134 billion.

Promotion of financial and Insurance Literacy

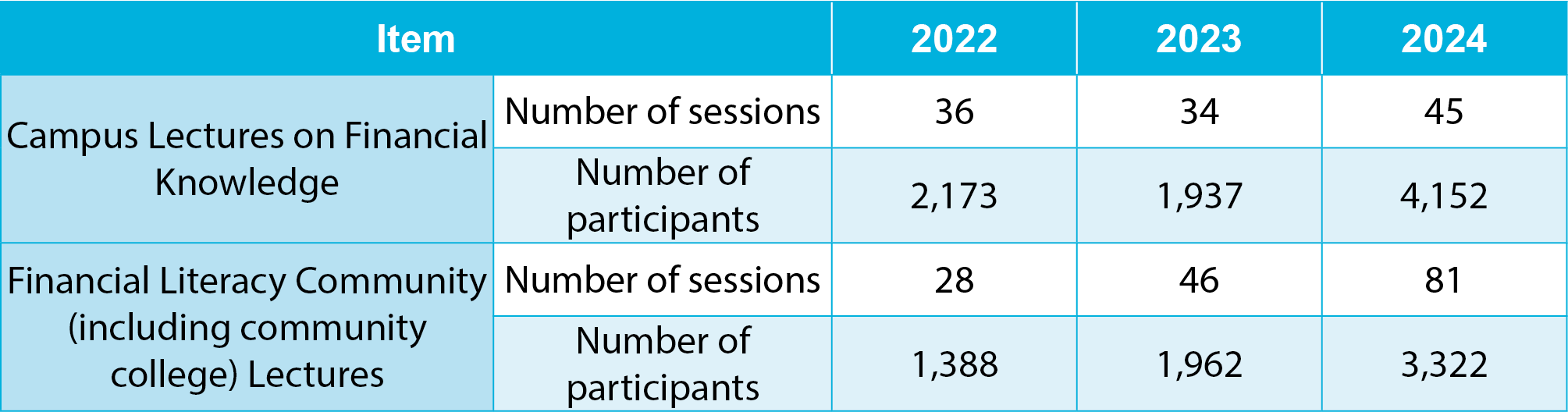

To enhance the public’s understanding of new type of financial services and the concept of prudent financial management, Chunghwa Post organizes the “Campus Lectures/Community Lectures on Financial Knowledge every year. According to questionnaire survey, the lecturers presented the content in a clear and easy-to-understand manner, and they also incorporated life experience and on-site interactions for the participants to better understand the overall financial knowledge and the payment tools. It is recommended that more sessions be organized. In 2024, a total of 126 sessions were held, with an achievement rate of 151.8%. To strengthen the public’s anti-fraud awareness, we will increase the number of lectures in the communities (including community college), and at least 80 sessions are expected to be held in 2025.

In terms of the postal life insurance businesses, Chunghwa Post’s 19 post offices contacted community groups, high schools or colleges in their jurisdiction and jointly organized the Postal Life Insurance Exchange Symposium and Insurance Knowledge Community/ Campus Lecture, and stayed close to customers to deepen relationships to understand customers’ needs and suggestions for postal life insurance while conveying the importance of insurance to help grasp the pulse of the market.

Prudent Execution of Insurance Operations

Chunghwa Post is dedicated to staying close to market demand. In 2024, we launched the online Simple Life Insurance products Jhen-Ai-015 Endowment and Xin-e88 term insurance for the public to choose from. As of the end of 2024, the number of registered salespeople was 25,584, who can provide relevant services to policyholders at any time in accordance with “Regulations Governing Business Solicitation, Policy Underwriting and Claim Adjusting of Insurance Enterprises”.

In addition, Chunghwa Post has also established the “Postal Simple Life Insurance Underwriting Systems and Procedures” and the “The System and Procedures for Claims Settlement of Postal Simple Life Insurance”, requiring the personnel to conduct underwriting in an impartial and detached manner, respond promptly to communications concerning claims, and treat policyholders with humility, fairness, and conscience to minimize the risk of legal action by beneficiaries pursuing payment of entitled insurance claims.

In addition, Chunghwa Post has also established the “Postal Simple Life Insurance Underwriting Systems and Procedures” and the “The System and Procedures for Claims Settlement of Postal Simple Life Insurance”, requiring the personnel to conduct underwriting in an impartial and detached manner, respond promptly to communications concerning claims, and treat policyholders with humility, fairness, and conscience to minimize the risk of legal action by beneficiaries pursuing payment of entitled insurance claims.

Promotion of a Healthy and Safe Life

In modern society, it is impossible to predict unexpected accidents, which makes it crucial for us to provide basic financial protection for ourselves and our families. “Postal Simple Life JI-AN/ JIN-PING-AN INJURY AND CHILD INJURY DISABILITY INSURANCE RIDER” is designed specially to deal with accidental injuries. When the insured becomes disabled or passes away due to an accident, insurance benefits will be provided to help alleviate the financial burden on their family. This insurance provides a long-term safety net, covering the insured until they reach the age 75, and covers unexpected external accidents not caused by illness, ensuring comprehensive protection against sudden risks. In addition, the premiums are affordable, making it suitable for risk management at home or when traveling.

Medical expenses are rising, and a single hospitalization can result in a significant financial burden. To allow the insured to receive treatment with peace of mind during hospitalization without worrying about their financial pressure, the “Postal Simple Life DAILY HOSPITALIZATION EXPENSE INSURANCE RIDER” provides comprehensive medical protection, including general hospitalization, payment for ICU and Burn Ward benefits, and covers hospitalization due to diseases or accidental injuries as stipulated in the contract terms. Coverage for illness begins 30 days after that rider takes effect or is reinstated, while accidental injuries are covered throughout the entire valid period of the rider, ensuring peace of mind for every insured person during health-related hardships.

Medical expenses are rising, and a single hospitalization can result in a significant financial burden. To allow the insured to receive treatment with peace of mind during hospitalization without worrying about their financial pressure, the “Postal Simple Life DAILY HOSPITALIZATION EXPENSE INSURANCE RIDER” provides comprehensive medical protection, including general hospitalization, payment for ICU and Burn Ward benefits, and covers hospitalization due to diseases or accidental injuries as stipulated in the contract terms. Coverage for illness begins 30 days after that rider takes effect or is reinstated, while accidental injuries are covered throughout the entire valid period of the rider, ensuring peace of mind for every insured person during health-related hardships.

Steady Investment

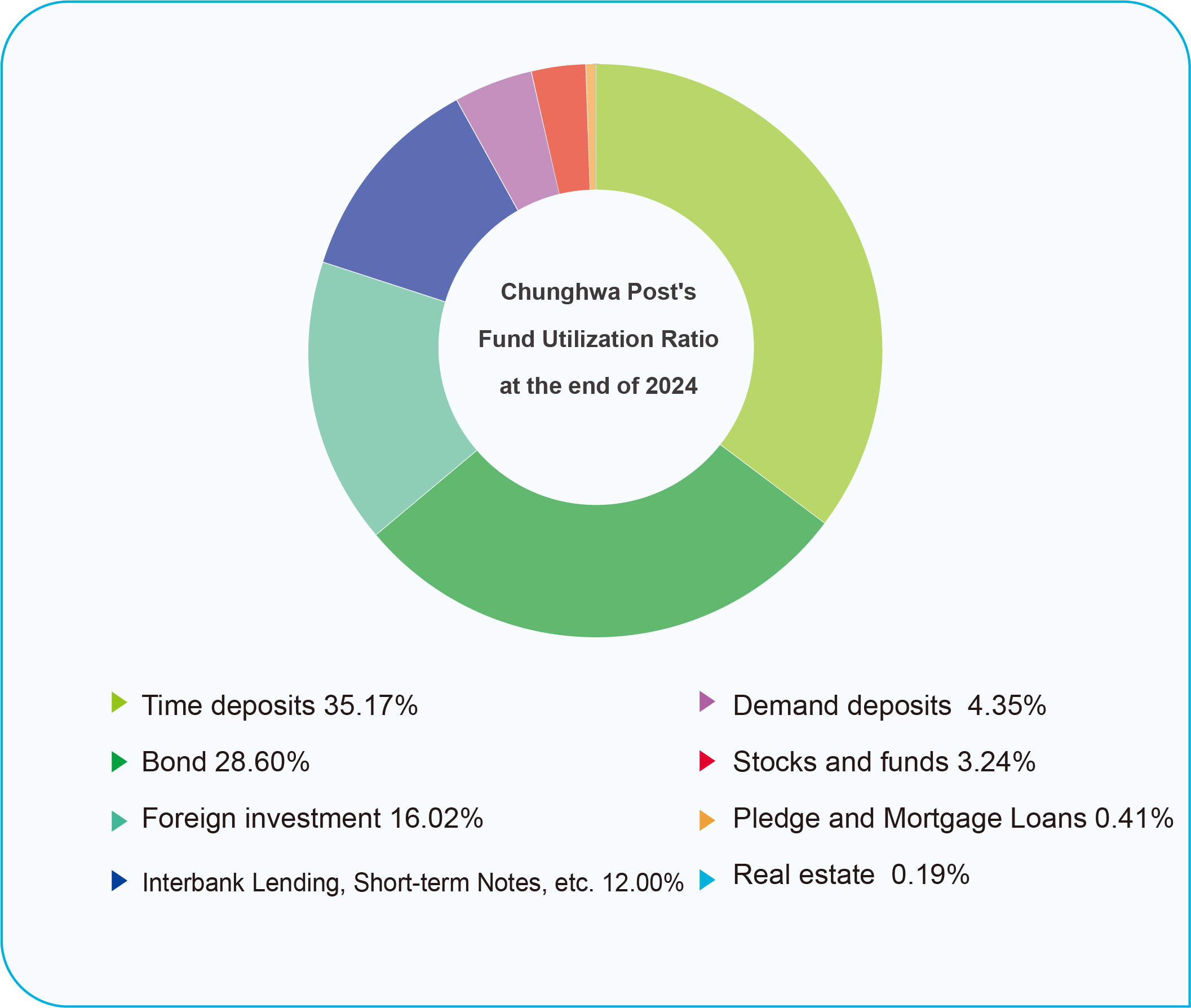

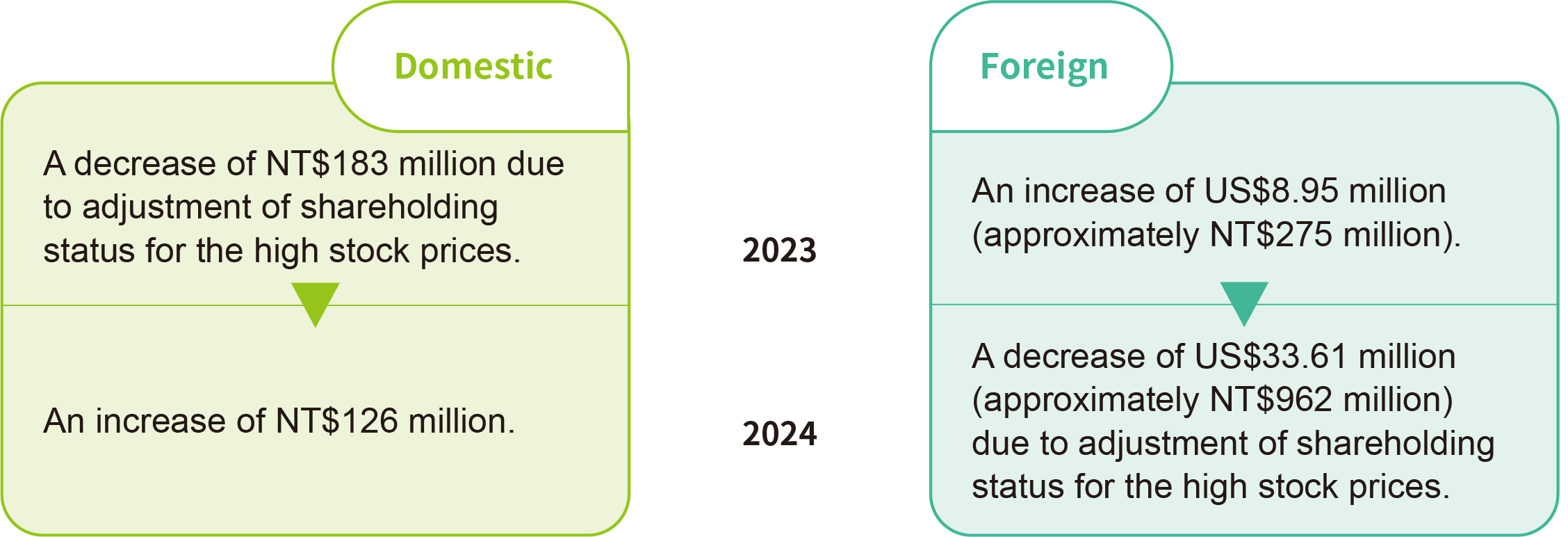

Chunghwa Post has maintained stable operation over the years. Despite the impacts of financial crisis, economic recession, and industry and capital outflows, the number of deposit accounts and balance amount of the savings business still tops domestic financial institutions. Chunghwa Post abides by relevant laws and regulations strictly and properly utilizes the funds from postal savings and simple life insurance. The personnel using funds have to comply with the Self-disciplinary Rules for Fund Manager and sign the declaration. The Department of Civil Service Ethics conducts regular inspection of the personal transactions of the personnel and keeps records on a regular basis. The number of personnel receiving the random inspection throughout the year exceeds 1/3 of the total number of personnel in the department.