Financial Inclusion

Chunghwa Post shoulders the policy mission of financial inclusion, and makes use of the advantages of the presence of operating sites across Taiwan covering outlying islands and remote areas to take care of the financially disadvantaged population. We also continue to keep being customer demand-oriented and adhere to the core values of “excellent services” and “being trusted by all people”, and provide friendly financial services. We align with the government’s financial digitalization policy, continue to promote payment channels such as the online payments and media transfer collection services, provide the public with convenient and safe mobile payment and electronic payment services, and thereby improving the digital financial literacy of all citizens.

Treat Clients Fairly

The Dispute Resolution Mechanism of Savings and Remittances Business and the Dispute Resolution Mechanism of Chunghwa Post Life Insurance Policyholders have been established in accordance with Financial Consumer Protection Act and the Principle for Financial Service Industries to Treat Clients Fairly to treat all financial consumers in a fair and reasonable manner and protect the rights and interests of them. In addition, Chunghwa Post has set up postage-free “Customer Opinion Forms” in the customer service area and the "suggestion box” on the official website as well as the 24-hour customer service hotline, providing customers with a variety of complaints and communication channels.

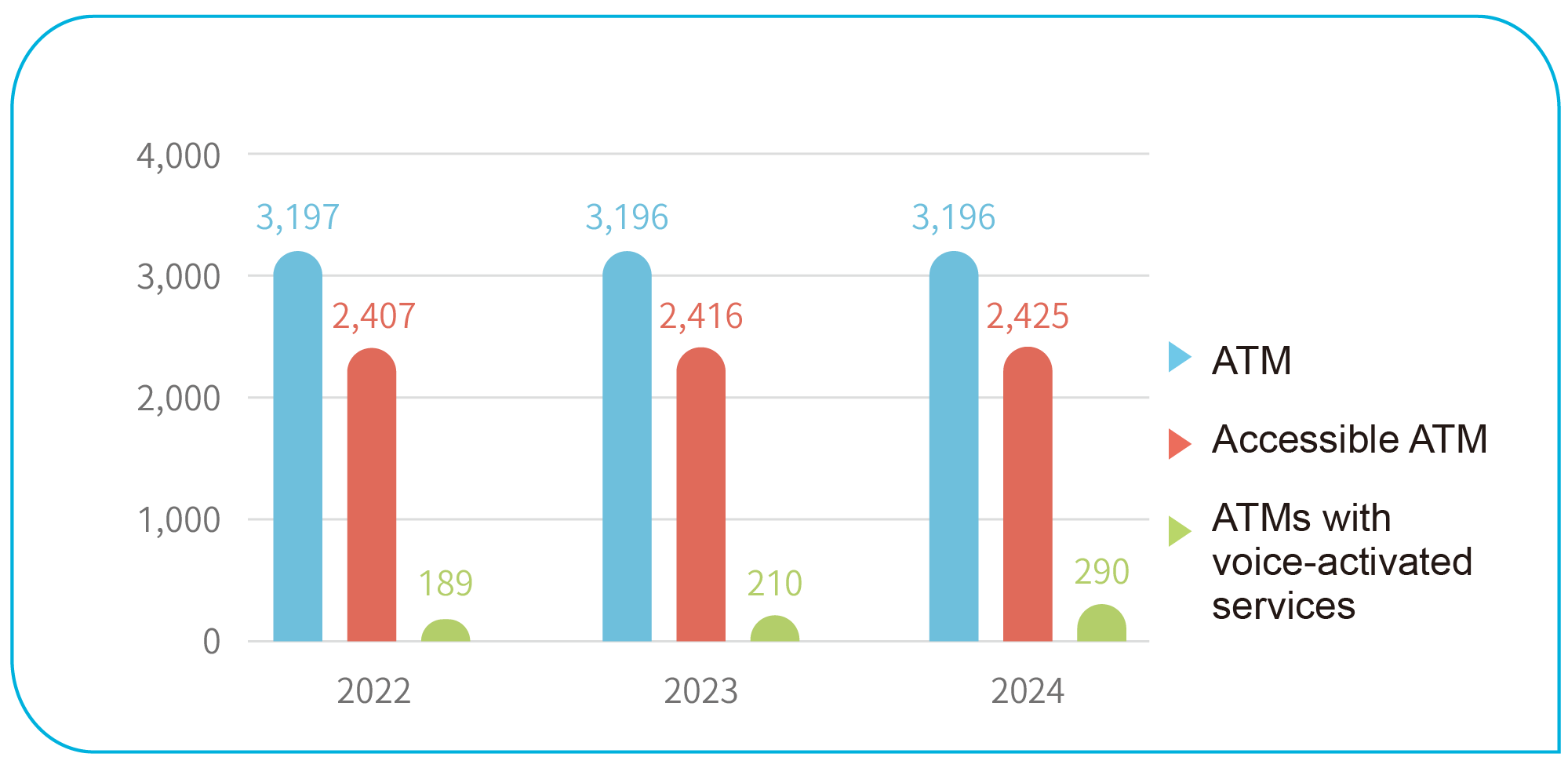

Friendly Financial Service Section

Establish a corporate culture that attaches great importance to Financial-friendly Service, and Chunghwa Post Co., Ltd.’s Compliance with Standards, Policies, and Strategies Outlined in the Banking Industry’s Financial Friendly Service Guidelines was established. Every year, educational training is organized for the directors, person in charge, senior management, supervisors, and counter staff. In addition, the supervisors and counter staff of each post office will carry out financial-friendly service drills on a regular basis.

Constructing a Robust Social Safety Net

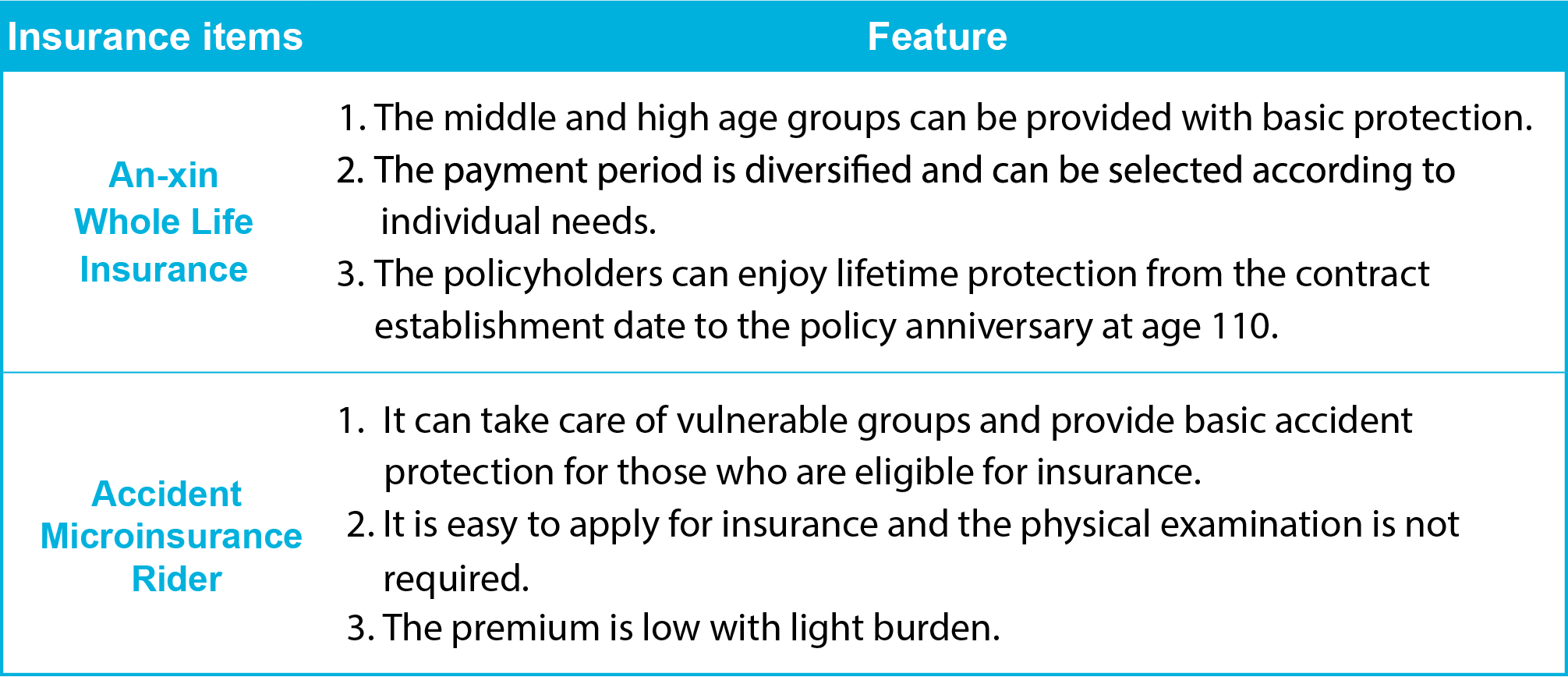

To cooperate with the policy of caring for the economically disadvantaged and given the rapid ageing population in Taiwan, there is an urgent need for the widespread adoption of basic insurance for the elderly. Chunghwa Post launched the Accident Microinsurance Rider and An-xin Whole Life Insurance in 2014 and 2017 respectively to assist the government in constructing a robust social safety net. In addition, revisions are made in accordance with relevant regulations of the Financial Supervisory Commission (FSC), and the insurance eligibility criteria are gradually loosened to enable more people to obtain basic coverage at lower thresholds. In 2024, the proportion of premium income in the first year of protection-type and elderly insurance products accounted for 99.85%.

The above two products are deeply trusted by the public. Through promotion and advocacy, we provide basic protection for the financially disadvantaged, and have been recognized by the Insurance Bureau of the Financial Supervisory Commission (FSC). We have won FSC’s “2024 Annual Microinsurance Contest”, “Outstanding Sales Award”, “Disability Care Award”, “Age-Friendly Award” and “General Coverage Award” of “2024 Small Amount Whole Life Insurance Competition”.

Digital Services

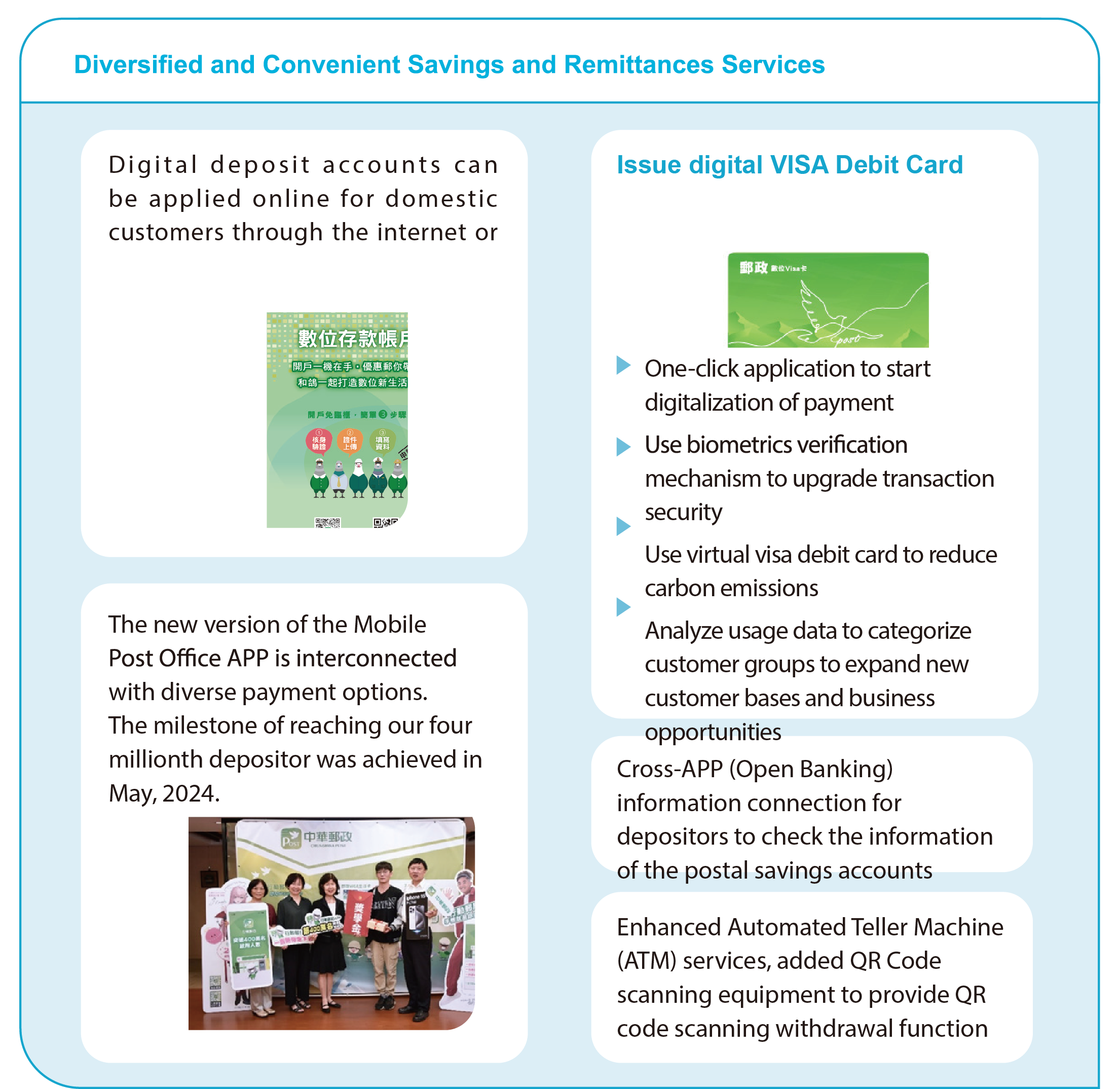

To meet customers’ demand for digital finance, Chunghwa Post actively conducts the integration of virtual and reality services, expands electronic services channels and works with Third-party Service Providers (TSPs) to use financial technology to embed postal financial services into people’s lives, creates a diverse and friendly financial environment, and carries out cross-field cooperation, providing multiple services including digital savings account, Mobile Post Office App, electronic payment that can be linked to the postal savings account, the Postal VISA Debit Card, open banking, and digital identity authentication, embedding postal financial services into people’s life scenes. We also actively plan the launch of innovative business to provide a life circle of postal digital financial services.

Mobile Device Insurance Service/ Online Insurance

The Mobile Device Insurance Service for the life insurance business has been launched since 2018. Policyholders do not need to visit the counter and can make use of rapid and convenient services of online reservation for insurance services, internet ATM insurance policy loan, and online application and inquiry functions. The number of policies purchased through the Mobile Device Insurance Service in 2024 totaled 33,334, with the achievement rate of 111.11%, and the cumulative number of policies purchased through the Mobile Device Insurance Service since the launch of this service totaled 81,813. Online Insurance Business was launched from March 21, 2022, and the first online insurance product, Postal Simple Life Insurance e68 Fix-termed Insurance, was released, providing insurance services that are not limited by time and space. The number of online insurance applications established amounted to 9,802 in 2024, with the achievement rate of 98.02%.